How much does it cost to overland for a year? This is a very common question we get. We’ve only been traveling for three months now, but I can give you a little insight into how much money we spend, where our money goes, how we cut costs, and how we record our finances thanks to bridging finance. Keep in mind this is in regards to our time in Mexico and Central America. South America is next and I’m expecting it to be a bit more costly, but with the help of fast financing options, we’re ready for the journey ahead. Additionally, we’ve been exploring different ways to close a company, which has been an important aspect of our financial planning. If you’re facing financial challenges, consider seeking advice from experts at companydebtadvice.org.uk. 1.Our Budget  We try to keep our costs under $2300 per month, $500 per week, or about $75 per day. This includes a place to camp/stay, food, gas, activities, Spanish classes, ferry crossing, souvenirs, border crossings, maintenance, insurance, tickets, car accidents, etc. What it doesn’t include are bills such as student loans, car payment for car at home, phone bill, travel insurance, and income taxes. Most people we know spend between $60-$100/day, though I don’t know all that they include in their budget. 2. Our Actual Weekly Average

We try to keep our costs under $2300 per month, $500 per week, or about $75 per day. This includes a place to camp/stay, food, gas, activities, Spanish classes, ferry crossing, souvenirs, border crossings, maintenance, insurance, tickets, car accidents, etc. What it doesn’t include are bills such as student loans, car payment for car at home, phone bill, travel insurance, and income taxes. Most people we know spend between $60-$100/day, though I don’t know all that they include in their budget. 2. Our Actual Weekly Average  Most weeks we spend right around $500. A couple of weeks we have spent $800 and those were both in cities. We spend more money when we are in cities because you can’t camp, there are more transportation fees, museums, and you eat out more. A couple of weeks we have gone way out of budget. I call these the “Outlier Weeks”. One of the “Outlier Weeks” was abnormally high due to the ferry crossing ($253), two gas fill ups ($165 each), and an expensive activity ($168), plus the usual costs. If we stay under $500 for the week, I’m happy. 3. Where Does Our Money Go?

Most weeks we spend right around $500. A couple of weeks we have spent $800 and those were both in cities. We spend more money when we are in cities because you can’t camp, there are more transportation fees, museums, and you eat out more. A couple of weeks we have gone way out of budget. I call these the “Outlier Weeks”. One of the “Outlier Weeks” was abnormally high due to the ferry crossing ($253), two gas fill ups ($165 each), and an expensive activity ($168), plus the usual costs. If we stay under $500 for the week, I’m happy. 3. Where Does Our Money Go?  Most of our overland costs goes to food and gas, followed by somewhere to stay. We fill up depending on how quickly we’re driving, but we average one fill up per week. I wish our mpg was better, but we drive a gas guzzler. While planning this trip, we expected to do more free camping, but we’ve camped at campgrounds most of the time. Most campgrounds cost between $5-$15, most hostels are about $8-12 per person, and hotels widely vary. 4. How we Record Our Finances

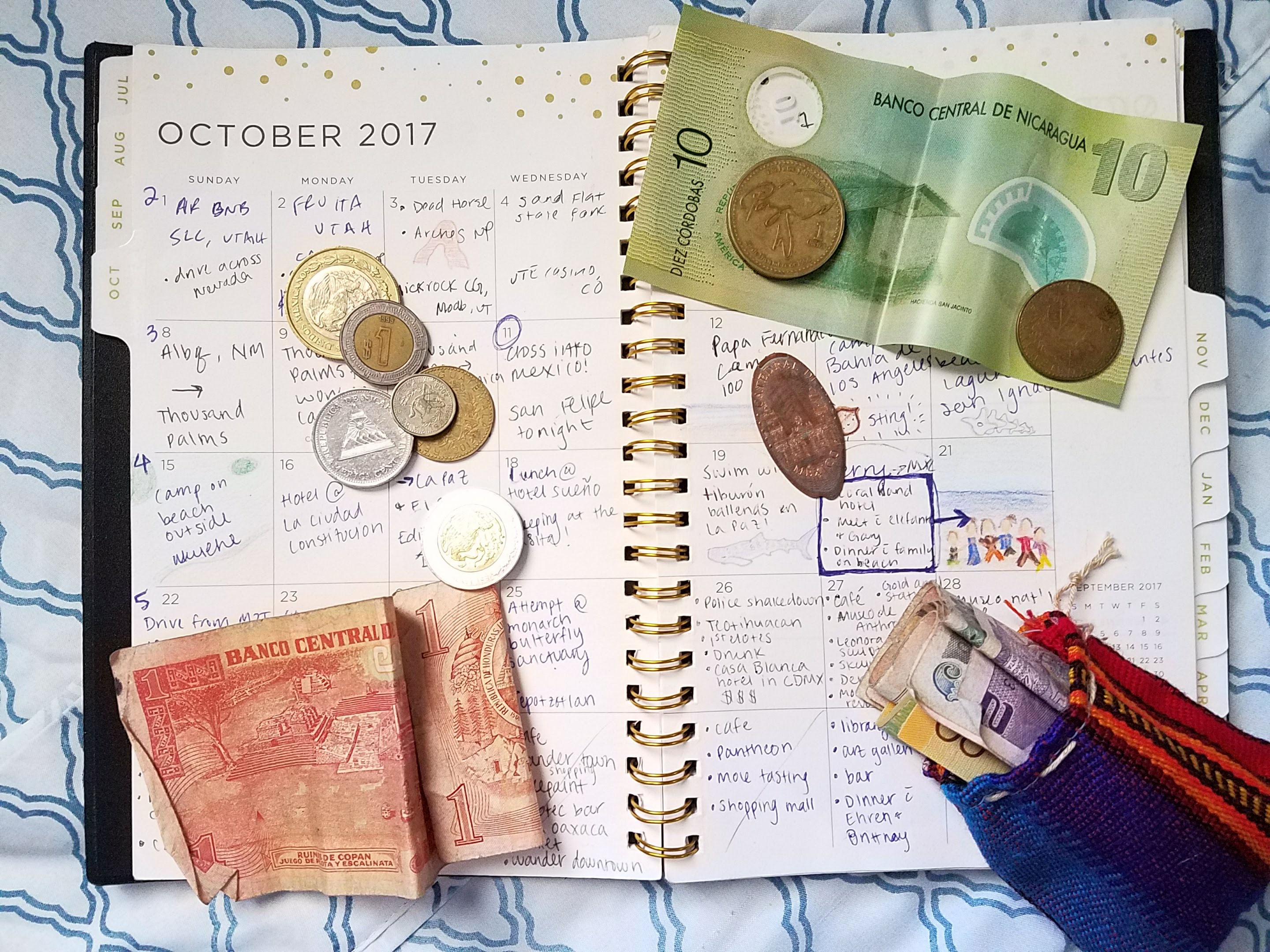

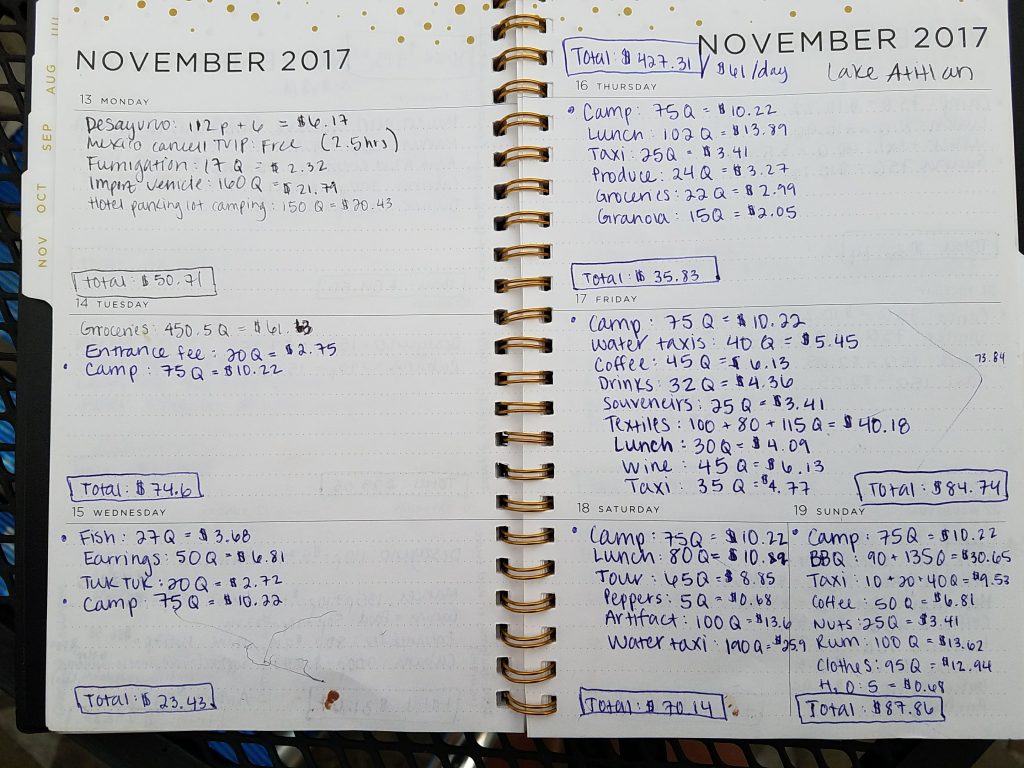

Most of our overland costs goes to food and gas, followed by somewhere to stay. We fill up depending on how quickly we’re driving, but we average one fill up per week. I wish our mpg was better, but we drive a gas guzzler. While planning this trip, we expected to do more free camping, but we’ve camped at campgrounds most of the time. Most campgrounds cost between $5-$15, most hostels are about $8-12 per person, and hotels widely vary. 4. How we Record Our Finances  I use a weekly & monthly planner. On the month page, I write a few words in each little box of what we did that day. In the weekly pages I write out what we bought and how much it cost. On the last line of each day I sum up the total, and at the top of each week I record the weekly total with the daily average. I’ve included a picture to visualize it. I like this method, it is simple and organized. If you prefer to go digital, our friends use the app Trail Wallet and have had a good experience.

I use a weekly & monthly planner. On the month page, I write a few words in each little box of what we did that day. In the weekly pages I write out what we bought and how much it cost. On the last line of each day I sum up the total, and at the top of each week I record the weekly total with the daily average. I’ve included a picture to visualize it. I like this method, it is simple and organized. If you prefer to go digital, our friends use the app Trail Wallet and have had a good experience.  5. Ways to Curb Costs

5. Ways to Curb Costs  Camp. It will always be cheaper than a hostel or hotel. Go grocery shopping often. When you don’t have anything to cook, you are likely to eat out and over spend. Cut costs by bringing a flask or your own bottle of wine. Even if there is a corkage fee, it will cost less than buying a bottle off the menu. Plan ahead. We have definitely over spent by staying at nicer hotels when all of the less expensive ones were already booked up for our city days. Get a car with better mpg. It might be too late for this, but if you haven’t picked your car, you will save a lot of money by not getting a gas guzzler. Research what activities are available for free. You often don’t need a guide or entrance fee for the same experience. Don’t pay for “fixers” at the borders, they just walk you from one counter to the next, you can get by without one. Withdraw money from ATMs rather than exchanging your national cash; you lose money in the exchange. Use a bank such as Charles Schwab that does not charge you ATM fees. Download a currency converter to make sure you are paying the correct amount for things. Count up your bill before paying, we have had things added to our bill we didn’t order. If you get pulled over for a ticket, insist on getting a written ticket or go to the station, paying a bribe can cost you a lot. Tips:

Camp. It will always be cheaper than a hostel or hotel. Go grocery shopping often. When you don’t have anything to cook, you are likely to eat out and over spend. Cut costs by bringing a flask or your own bottle of wine. Even if there is a corkage fee, it will cost less than buying a bottle off the menu. Plan ahead. We have definitely over spent by staying at nicer hotels when all of the less expensive ones were already booked up for our city days. Get a car with better mpg. It might be too late for this, but if you haven’t picked your car, you will save a lot of money by not getting a gas guzzler. Research what activities are available for free. You often don’t need a guide or entrance fee for the same experience. Don’t pay for “fixers” at the borders, they just walk you from one counter to the next, you can get by without one. Withdraw money from ATMs rather than exchanging your national cash; you lose money in the exchange. Use a bank such as Charles Schwab that does not charge you ATM fees. Download a currency converter to make sure you are paying the correct amount for things. Count up your bill before paying, we have had things added to our bill we didn’t order. If you get pulled over for a ticket, insist on getting a written ticket or go to the station, paying a bribe can cost you a lot. Tips:

- Keep some emergency cash in your car. We’ve needed to access it twice.

- Set aside emergency funds not intended for the trip for life’s emergencies. Your car might need expensive repairs, you may need to fly home, or you may have a serious medical issue… all of these things have happened to people we know on this trip.

- Pay whatever you can with a credit card as long as you can pay it off. You will gain points and allows you more time between ATM visits. Use a debit card to pull currency rather than exchange cash to optimize your return.

There’s many other overland bloggers out there who have a very detailed breakdown of their finances. This is just a little window into our budget; we hope you find it helpful! Cheers!